Key findings

- Renewable-energy projects' future appears uncertain due to integrity concerns, particularly around additionality. MSCI's integrity assessments of 1,700+ projects show they are the lowest-rated project type, with 78% scoring less than three out of five (versus 30% across all other projects).

- In recognition of these concerns, on Aug. 6, the Integrity Council for the Voluntary Carbon Market (ICVCM) decided that renewable-energy projects would not receive its high integrity Core Carbon Principles (CCP) label.

- Despite the lower ratings of these projects, carbon credits can still play a role financing renewable-energy expansion. Efforts going forward should focus on projects that cannot operate without carbon-credit financing.

In support of society's ever-growing need for energy, the global carbon-credit market has channeled finance to renewable projects for over a decade. Since 2010, over 750 million voluntary carbon credits have been issued by some 1,700 renewable-energy projects. This accounts for 30% of all credits issued, and 36% of credits retired by corporates. Some 40% of issued credits have come from wind projects, 30% from hydro, 15% from solar and 15% from other renewable types.[1]

Despite their historical prevalence, renewable-energy projects as a source of credits seem to be running out of steam. While global investment in renewable energy rose by 8% in 2023 to USD 623 billion, virtually none of this new funding was provided via carbon credits.[2]

Furthermore, in 2020, the two largest carbon-crediting standards, Gold Standard and Verra, imposed restrictions on the eligibility of new renewable-energy projects to generate carbon credits, citing falling costs of wind and solar power and prevalent government schemes to support their adoption. Verra now only permits projects from new renewable-energy projects in Least Developed Countries, and only if they are not large-scale hydro. Gold Standard only allows new projects in small-island and landlocked developing countries, and in nations where the penetration of the technology concerned is less than 5% of total grid-connected capacity, as well as offshore wind and waste-to-energy projects.

Finally, just this week (Aug. 6), the ICVCM announced that all renewable-energy credits would fail its integrity benchmark as they are "insufficiently rigorous" in their additionality.[3]

Assessing the integrity of renewable-energy carbon credits

Despite restrictions on new renewable-energy projects, there are still 350 million carbon credits available for purchase from currently registered projects, and more may be issued. Corporates looking to use these credits should certainly consider their integrity ahead of any purchase.[4]

MSCI Carbon Markets assessed the integrity of more than 1,700 existing renewable-energy projects, scoring each out of five.[5] While they all undoubtedly have climate benefits, they can carry material risks from a credit-integrity perspective.

On the positive side, renewable-energy projects score highly on their "quantification" risk (as the electricity generated by a renewable plant is generally easily and accurately measured) and "permanence" (given they prevent the release of carbon rather than storing it, unlike, say, forestry projects). Instead, their key integrity issue is their "additionality" (that the project in question would have proceeded without the carbon-credit revenue stream).

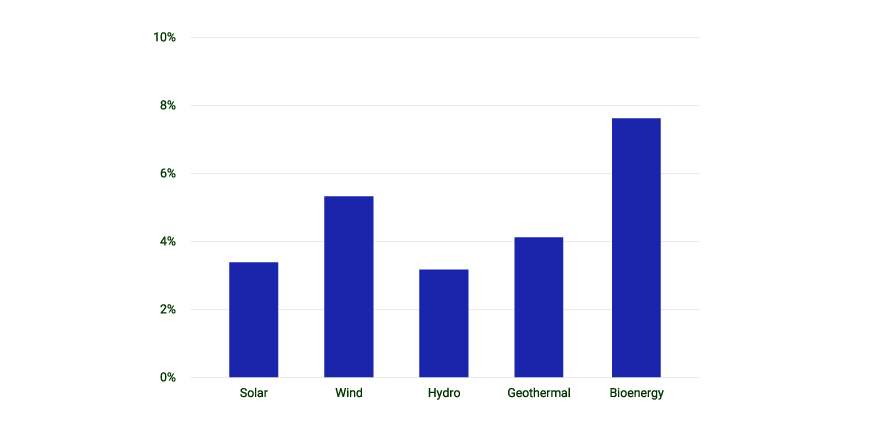

There are two typical ways to assess this additionality — through investment returns or "common practice."[6] When considering the former, of the more than 1,700 registered projects we examined, carbon credits represented less than 4% of their total revenue, with hydro and solar closer to 3% (as shown in the exhibit below). With carbon credits representing such a low proportion of future revenue, it is less likely that they drove the decision to develop the renewable-energy plant, particularly for larger-scale hydro, wind or solar plants where upfront capital costs can run into hundreds of million dollars.

Percentage of project revenue coming from carbon credits

Based on a sample of 1,726 projects. Revenue data directly based on project data on estimated issuances, electricity generation and electricity-tariff prices. Source: Project documentation, MSCI Carbon Markets

Investment returns don't always tell the whole story, however. In some markets, there are other barriers to the adoption of renewable energy, such as lack of grid infrastructure, low creditworthiness of electricity purchasers, administrative hurdles or political risk. These aspects are captured in the common-practice assessment.

If a type of renewable energy is already prevalent in a market, then it suggests that the project would be feasible without the carbon-revenue stream. The typical threshold used is whether the technology represents 5% or more of the electricity mix. If this threshold is met it is assumed that common practice already exists, and if not, then there is a case for a carbon-credit project being additional.

The relevance of the common-practice test differs by market size. For larger markets, even 5% of the electricity mix requires significant technology deployment, to the point that it could be regarded as common practice, given the sheer size of the power sector.

This is illustrated by looking at the electricity mix of China, India and Turkey. Hydro power represented over 10% of the electricity mix in all three markets since 2000, meaning it wouldn't be eligible on the common-practice basis. Wind would not, however, have passed the common-practice test in China until 2017, in Turkey until 2016 and still fails for India. Solar has never represented more than 5% of the electricity mix in any of these markets, but arguably is a widely investable technology type. Consequently, for these large developing economies, investment-return analysis is the more relevant test of additionality.

In smaller markets with less-developed infrastructure and support mechanisms for renewables, common practice is a more useful indicator of additionality. In these markets there are many reasons why renewables are challenging to develop, and carbon credits may play a stronger role in stimulating new investments.

Penetration of renewable-energy project subtypes by market (% electricity production)

Source: Our World in Data

Buyer beware

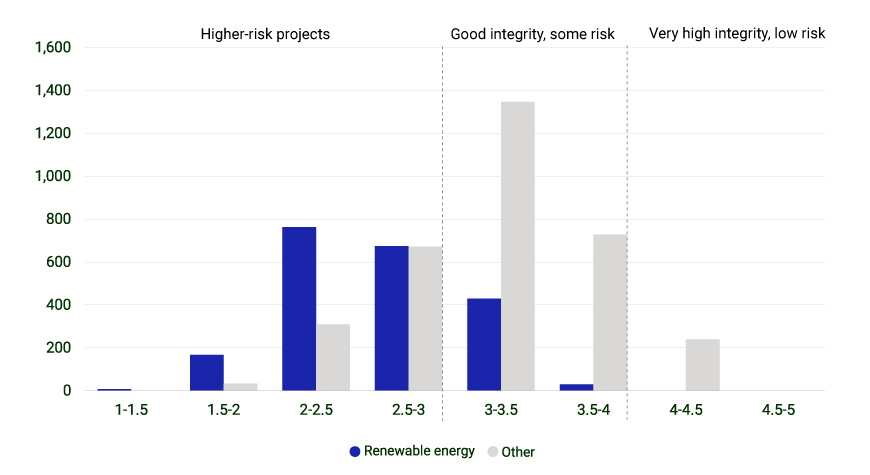

Taking these criteria and others into account, our analysis shows that renewable-energy projects are typically the lowest rated for integrity in the carbon-credit market. While there is variation depending on project specifics, 78% of renewable-energy projects received an overall MSCI integrity score of less than three out of five, representing very high integrity risk, compared to 30% for other project types, as detailed in the final exhibit.

In the renewables sector, the highest integrity scores tend to correlate with technologies such as micro-scale and off-grid renewables projects and organic waste to energy, where the case for additionality from carbon-credit finance is strongest. These projects are often undertaken in less- and least-developed economies.

Number of voluntary carbon projects by overall integrity score

All projects are scored on a scale of one to five, where one is the minimum and five is the maximum. Overall integrity scores based on balanced weighting. Source: MSCI Carbon Markets

These integrity concerns, together with significant supply volume, are reflected in the price of credits. MSCI Carbon Markets data shows that renewable energy was consistently the lowest-priced type of carbon credit with average prices between just USD 1.80 and USD 2.80 per tonne of CO2 equivalent during the first half of 2024, compared to USD 10 or more for nature-restoration credits, and around USD 5 for clean-cooking credits.[7]

Silver linings

Displacing fossil-energy sources at scale will be expensive, despite the decline in the cost of clean energy. It remains to be seen, though, if the voluntary carbon market is the best-suited funding mechanism to support this growth in renewable-energy capacity.

Some think it is. The relatively new Global Carbon Council (GCC) registry contains nearly 1,000 renewable-energy projects in their pipeline, although it is unclear how many of these the GCC will eventually register. Given the ICVCM's recent decision on renewable-energy projects, it seems unlikely many of these will pass the ICVCM's eligibility tests.

Others are trying a new approach by using carbon credits to transform energy systems at a jurisdictional or systemic scale. The Energy Transition Accelerator (ETA) is one such example. First proposed in November 2022 by the U.S. government, it seeks to use high-integrity carbon crediting to mobilize between USD 70 and 200 billion in energy-transition finance in developing countries by 2035. Separately, the Coal to Clean Credit Initiative was launched in December 2023 by the Rockefeller Foundation in collaboration with ACEN Corporation, South Pole, the GEAPP and others. This initiative is exploring the use of carbon credits to finance the replacement of coal-fired power plants with renewable energy in emerging economies, with a first pilot project in the Philippines.

These initiatives could transform the degree of support that carbon markets provide to the energy sector, but their impact is likely to hinge on two factors. First, whether carbon credits will be directed toward the types of renewable-energy projects most at need of additional carbon-credit financing.[8] Second, whether demand for carbon credits can be secured in advance. Without this upfront commitment to buy credits, it becomes more challenging to justify the additionality of such capital-intensive projects.

The ICVCM's recent decision to rule out all renewable-energy credits from CCP eligibility signals a commitment to establishing a significantly higher threshold for integrity going forward but is a somewhat blunt approach. Many renewable-energy projects score poorly on our integrity scale, but not all. The ICVCM's strict line on all renewable projects comes at the expense of rejecting a smaller number of better-performing projects. The ICVCM has, however, said it is ready to review new, and more rigorous, renewable-energy methodologies, so it remains possible that some renewable-energy projects could still play a role in powering the carbon-credit market.

Footnotes

- Includes credits issued by the following registries since 2010: ACCU, ACR, ART Trees, BioCarbon, CAR, CDM (NDC eligible credits only), Climate Forward, EcoRegistry, GCC, Gold Standard, PuroEarth and Verra. ↩

- BloombergNEF estimates. ↩

- "Carbon credits from current renewable energy methodologies will not receive high-integrity CCP label," ICVCM press release, Aug. 6 2024. ↩

- Note that within the carbon-credit market, the terms quality and integrity tend to be used interchangeably. Carbon credits can be of varying quality, and low-quality carbon credits have received significant academic and media scrutiny in the last couple of years. Quality issues raised recently include the overstating of a carbon project's emissions impact, a potential lack of permanence in forestry projects and allegations of social / ethical malpractice. ↩

- MSCI Carbon Market's carbon-project integrity ratings assess integrity across five different criteria: additionality, quantification, permanence (collectively, emissions-impact integrity), co-benefits and legal and ethical risks. The overall integrity of a carbon credit depends on how these five factors are weighted. A number of different weightings are available on the MSCI Carbon Markets platform (opens in a new tab). ↩

- Common practice analysis is often used to test additionality and is, in short, a check to determine whether the proposed project has already become common practice in the relevant sector and region – if it has, then it is less likely that carbon credit finance is needed to support a new project. ↩

- Prices are volume weighted average carbon-credit spot prices. Prices and volumes represent a mix of settled transactions and asks, although greater weighting is given to settled transactions. ↩